Every economic bust launches criminal charges against executives of failed companies. It’s been a few years since the collapse of Lehman Brothers and the onset of the Global Financial Crisis but the court cases in many instances are still ongoing. One of the most notorious cases in Australia was the child-care center empire of ABC Learning Centers. The entrepeneur-founder Eddy Groves and another director are facing charges relating to shifting money out of the business in the months leading to the collapse.

I do a lot of my strategy work with Kevin Hendry who has a keen interest in strategy and corporate failure. Kevin was the Asia-Pacific Vice President of Monsanto during its venture into GMO agriculture and has first-hand experience of the events that lead to a corporate blow-up. While we tend to focus on late-stage actions that end up in the courts, Kevin says that the beginnings of these cases often start with bad strategy. While ABC Learning ended in white collar crime charges, it started with the belief that education services could be made profitable through economies of scale that were achieved by multiple acquisitions. Anyone involved in education knows that relationships are the core of education and relationships are really hard to scale up. In hindsight the flaw was obvious but everyone bought the growth story, including the Singaporean government who bought half a billion dollars in shares in a 2007 capital raising to fund a major acquisition in the US.

In an excellent series of cases studies of corporate collapses after the 1990s boom, Grant and Visconti (2006) detected a consistent pattern in strategic misalignment leading to the corporate accounting scandals of 2001-2003. Overconfidence created by prior success leads to diversification into different products and countries where the model for success may not be valid. Here are some of Grant and Visconti’s examples:

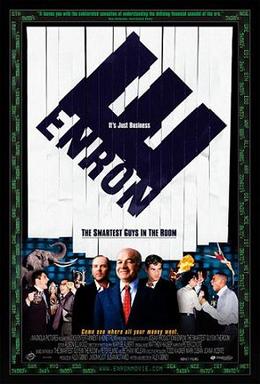

-Enron expanded from natural gas into power, water, telecommunications and derivatives trading, and expanded its presence outside the US – notably in Europe.

-WorldCom transformed itself from a long-distance phone company into a diversified supplier of telecommunication services – including internet and data services with interests overseas as well as in the US.

-Adelphia grew from being a local cable TV company into a US-wide cable provider supplying not just TV but internet, data and other video services.

-Global Crossing expanded internationally to become a global player in telecommunications infrastructure.

-HealthSouth grew from being a local outpatient surgery provider to what its CEO described as ‘‘the Wal-Mart of outpatient rehabilitation’’ offering integrated surgery, rehabilitation, home care and pharmaceutical services throughout the US.

-AOL expanded from being an internet service provider into the world’s biggest and most diversified media company.

-Parmalat expanded from a Parma-based dairy into a diversified food products supplier with operations in 30 countries.

There are enough consistencies here to identify three links between all of the companies that ended in corporate fraud cases.

1) Strong orientation towards growth

2) Useage of mergers and acqusitions to accelerate growth

3) Reliance on debt finance

The fraud usually creeps in when the strategy fails to generate returns and the debt gets bigger. In these cases the temptation to ‘cook the books’ just long enough to let the turnaround happen is almost overwhelming. Small adjustments to reports become bigger and bigger until the receivers reveal the full horror of the failure.

The main takeaway is the fundamental importance of revisiting the business model and understanding what the key factors are that make it work. Kevin says that Monsanto could have made the GMO business work if they had invested more in building a public relations and govermment liaison capability rather than just investing more into the science.

Success and overconfidence are major risk factors for business. Some confidence is good but hubris is a destroyer.

Kevin runs a 4 day seminar in Brisbane on corporate governance and the skills that are needed to be an effective director. I would recommend it to anyone involved with boards as a manager or director.

Well said. This is important stuff for companies to know!

This also works in the Agile world as well. Having a solid strategy is so important!